How Levi Strauss Dominated Denim

Transcript

What was the most lucrative product to come out of

the California Gold Rush? Not gold. At least, not

for the vast majority of miners, for whom the

Gold Rush was basically a bust. But the merchants

who served those miners? Well, they had a golden

opportunity indeed. All those new miners needed

products, housing, food, and clothing. Lots and

lots of clothing. Enter Levi Strauss. Sound

familiar? Yeah, he should. But hold on a second.

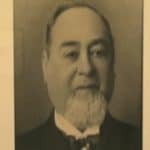

Strauss was a German immigrant who arrived in San

Francisco in 1853 to open Levi Strauss & Co., a

wholesale dry goods business to cater to

California’s exploding population. That went

okay. But it took another 20 years for Strauss’s

real breakthrough: blue jeans. That’s why you

know his name. One of Strauss’s customers, a

tailor from Latvia

named

Jacob Davis, bought denim fabric from Strauss to

sew various products for his customers: tents,

wagon covers, and now, pants. Davis wrote to

Strauss for help to patent and market his

invention: denim pants strengthen with copper

rivets. They received a patent for the pants in

1873. But while jeans are still a worldwide

sensation 150 years later, Levi’s itself hasn’t

always struck gold. The company rose to fame as a

hearty, all-American brand.

Everybody has a Levi’s story. First date, first

kiss, going to college. Everybody has a Levi’s

story, and we’ve capitalized on that. But it has

struggled to maintain the public’s loyalty.

Now, after a rocky recovery, it’s poised to go

public again in 2019. The big question now? Will

this be a boom or bust for the company that

invented jeans?

For its first 70 years, Levi’s were the pant of

America’s working class: miners, ranchers,

factory workers and more. Levi’s dominated the

jean market until 1913, when rival brand Lee

rolled out its Union Alls. A few decades later,

Wrangler introduced its jeans fashioned with felt

seams and deeper watch pockets for the modern day

cowboy.

So competition was heating up. But the denim

market was about to experience a major boost.

How? World War II and the baby boomers. Jeans

made their worldwide debut during World War II as

American soldiers wore the casual pants around

Europe when off-duty.

That kind of got consumers to just see something a

little bit different because everybody was so

much more formal. Men were wearing hats and

suits, ladies wore suits and coats and, you know,

fur scarves. I mean it was a very formal culture,

globally. And I think that was really, like, the

start of this global trend within denim.

When soldiers returned, jeans stuck around. But it

took a boost from the silver screen to transform

jeans from strictly functional to fashion

statement.

John Wayne first popularized denim with his rugged

cowboy characters in popular Western movies

during the 1930s and 40s. But denim’s real

breakthrough came from 1950s Hollywood movies and

the teenagers who watch them. When James Dean

donned jeans and a leather jacket in Rebel

Without A Cause, he kicked off a fashion

sensation. Jeans, leather jackets, those hats,

I mean it was very, very rebellious. It was very

different from what the culture was used to.

Though

Dean wore jeans from Levi’s rival company, Lee,

Levi’s themselves graced the legs of famous stars

in other popular movies.

These films introduced jeans as a symbol of sexy

rebellion to America’s teenagers. Some school

districts even banned students from wearing them.

This growing popularity helped Levi’s expand

nationwide. Young Baby Boomers across the country

wore their Levi’s to the sock hops of the 50s,

the music festivals of the 60s, and the protests

of the 70s.

What makes the Levi brand so successful is their

ability to keep re-engineering and introducing

themselves to the next jeanration. They are one

of the few denim brands that continually maintain

their customer base and find ways to get the new

and upcoming youth market to think about denim

and Levi’s together.

Capitalizing on this success, Levi’s went public

for the first time in 1971, and its sales grew at

an annual clip of 37 percent during the late 70s.

The denim market as a whole was booming, peaking

in 1981 with nearly 590 million jeans sold.

Levi’s and its top two competitors, Lee and

Wrangler, represented over 40 percent of the

denim market. But this denim rush slowed in the

early 1980s. Levi’s, though firmly cemented as an

iconic American brand, began to struggle. First

the company fell behind fashion trends. Amid the

slumping jeans market of the 80s, designer jeans

from Calvin Klein and Jordache came into vogue.

They gave the pants the sex appeal that Levi’s

classic 501s lacked, and consumers bought them

for nearly double the cost of Levi’s. At the same

time, the major clothing retailer VF Corporation

merged with Wrangler’s parent company Blue Bell.

Now, two of Levi’s top competitors for the

classic American jean market, Wrangler and Lee,

were both under VF Corp. Levi’s revenue plunged

78 percent in the first half of 1984, a worrying

stumble for a publicly-traded company. Levi

Strauss’s descendants decided to take on 1.6

billion dollars in debt to buy back the majority

of the company, taking it private and freeing it

from the pressures of Wall Street. It was the

biggest deal of its kind in the apparel industry

at the time.

Once it went private, Levi’s acted fast to compete

in a tough denim market. It closed eleven plants

and laid off 3,600 employees. It invested in

marketing and technology and introduced its

business casual brand Dockers in 1986. Dockers

focused on trendier, non-denim trousers, which

cut into VF Corp’s jean sales. Denim boomed again

in the 1990s. Levi’s sales peaked in 1996 at $7.1

billion dollars. The company was paying its debt

years ahead of schedule, so Strauss’s descendants

borrowed another 3.3 billion dollars to buy back

the rest of the company. But Levi’s still

struggled to stay relevant. It missed the baggy

jeans trend of the 90s and the hip-hugging style

of the early 2000s. Cheaper private label brands

sold at J.C. Penney and Gap ate into Levi’s sales

in the 1990s, followed by new upscale competitors

like 7 For All Mankind, Diesel, and True

Religion in the early 2000s. Battered by

competition, Levi’s sales fell every year from

1997 to 2002. Still saddled with debt, the

company recruited the first non-family member to

serve as CEO: Phil Marineau.

Marineau and his successor, John Anderson, cast

around for solutions. They considered selling the

Dockers brand and teased going public again.

Levi’s sales recovered somewhat by 2007 but fell

again when the financial crash devastated the

garment industry. Some analysts argue that Levi’s

reputation as a classic American brand has seen

the company through fickle fashion trends and

economic woes.

They can ride out the storm. They’re not worried

about being the first and the trendsetter,

they’re worried about maintaining their volume

and their core customer business and achieving

growth within the new customers. But even that

all-American reputation has faded.

The 80s and 90s saw the rapid outsourcing of

garment production from the US to countries with

cheaper labor. This allowed Levi’s competitors to

slash prices, luring customers away from the

Levi’s brand. This flew in the face of both

Levi’s all-American reputation and its

longstanding relationship with its employees.

When the great San Francisco fire burned down the

Levi’s factory in 1906, Levi’s kept paying

workers. And when sales fell during the Great

Depression, Levi’s paid its employees to put in

new factory floors rather than laying them off.

So Levi’s resisted outsourcing. It closed some

plants in the 80s and 90s, but held onto others

until finally closing its last U.S. plant in

2004. When announcing the final plant closures, a

Levi Strauss Company spokesman told NBC News: “We

tried to do our best to maintain manufacturing in

the United States, but we have to be competitive

to survive as a company.” Now, the vast majority

of Levi’s all-American jeans come from China,

Vietnam, Mexico, and elsewhere.

So by the mid 2000s, Levi’s faced massive debt,

sluggish sales, and a waning reputation as an

all-American icon.

They’ve got their base. What they’ve got to appeal

to is sort of break the mold of Levi’s as Levi’s

classic, to increase their fashion-ability and

that so of speak. But they can’t go too far.

Enter Chip Bergh. Bergh, another Levi’s outsider,

took over as CEO in 2011.

The brand lost its way back in the late 90s and

early 2000s. We lost a lot of consumers. We lost

our mojo. I saw this as kind of an enormous

opportunity and an enormous challenge.

He encouraged the company to focus on what worked,

like the core men’s bottoms business, and

strengthen weaker areas. He revamped stores and

its e-commerce site, but found the most success

with women’s jeans. Using its new Eureka

Innovation Lab, an in-house research and design

initiative, sales increased from under 800

million dollars to over one billion dollars in

under three years. Additionally, fashion trends

are finally back on Levi’s’ side. Nostalgia for

the 1980s and 1990s has brought back light wash,

distressed, and mom jeans, and a taste for Levi’s

501s. Kanye West wears a Levi’s vintage trucker

jacket, while his famous family sports Levi’s on

Instagram and in their 2017 Christmas card.

Levi’s even got a taste of the hysteria of a

high-profile sneaker drop when they remade the

Air Jordan IV sneakers in denim in June of 2018.

Finally, Levi’s placed itself prominently in the

public eye. First, in 2013, it signed a 20-year

220 million dollar deal for the naming rights to

the San Francisco 49ers stadium. The stadium and

its employees, including the cheerleaders, are

now plastered with Levi’s advertising. “The

people who attend concerts and NFL games are our

core customers,” Bergh wrote for The Harvard

Business Review. “So this would put our brand

back at the center of the cultural conversation.”

Second, Levi’s joined other retailers and taking

a public stand against gun violence in 2018.

Bergh, a former Army officer, wrote an op-ed for

Fortune promising 1 million dollars in donations

to anti-gun violence activists and five hours of

paid volunteer time each month for Levi’s

employees. He had previously asked customers not

to bring firearms into Levi stores in 2016. Burke

stated that he received threats against Levi’s

Stores and even himself after posting the op-ed,

but he responded that they “pale in comparison to

threats against other activists and the daily

threats of gun violence faced by many across the

country.”

This brand is at its best when we’re at the center

of culture. We were there when the Berlin Wall

fell down. We were there through the riots in the

60s and 70s. So we put the brand back at the

center of culture.

So with innovation, trends, and bold public moves,

Levi seems to be recapturing some its iconic

essence. They consistently captured around 11

percent of the U.S. total denim market from 2012

to 2015, and their annual sales slowly crawled

back up to 4.9 billion dollars in 2017. It was

their highest sales numbers since 1999, and it

happened as the rest of the U.S. jeans market

took a beating.

But this is still a far cry from its 1996 sales.

Staying private helped the company make long term

investments in its business, but it still has

more than a billion dollars in total debt. So

today, with the denim industry set to grow,

Levi’s is once again considering going public in

2019. Sources tell CNBC that Levi’s is aiming to

raise as much as 800 million dollars, which would

value the company at five billion dollars. That

kind of cash could help it finally pay off its

remaining debt and focus on growth. CNBC reached

out to Levi’s for an interview, but they

declined. This potential IPO comes as the parent

company of Lee and Wrangler is splitting its

denim division into its own public company. VF

Corp. announced a decision in August 2018, saying

it wanted to focus on its activewear brands like

The North Face and Timberland. It’s a move some

say indicates its denim brands were weighing on

overall profits. But most analysts maintain that

Levi’s still stands to gain quite a lot from

going public. It could be a golden opportunity to

reclaim its place as an American icon.